Real Property Tax payments were due January 15, 2026. Bills were made to property owners in October 2025.

The money collected through the Real Property Tax payments funds County operations and services to the community.

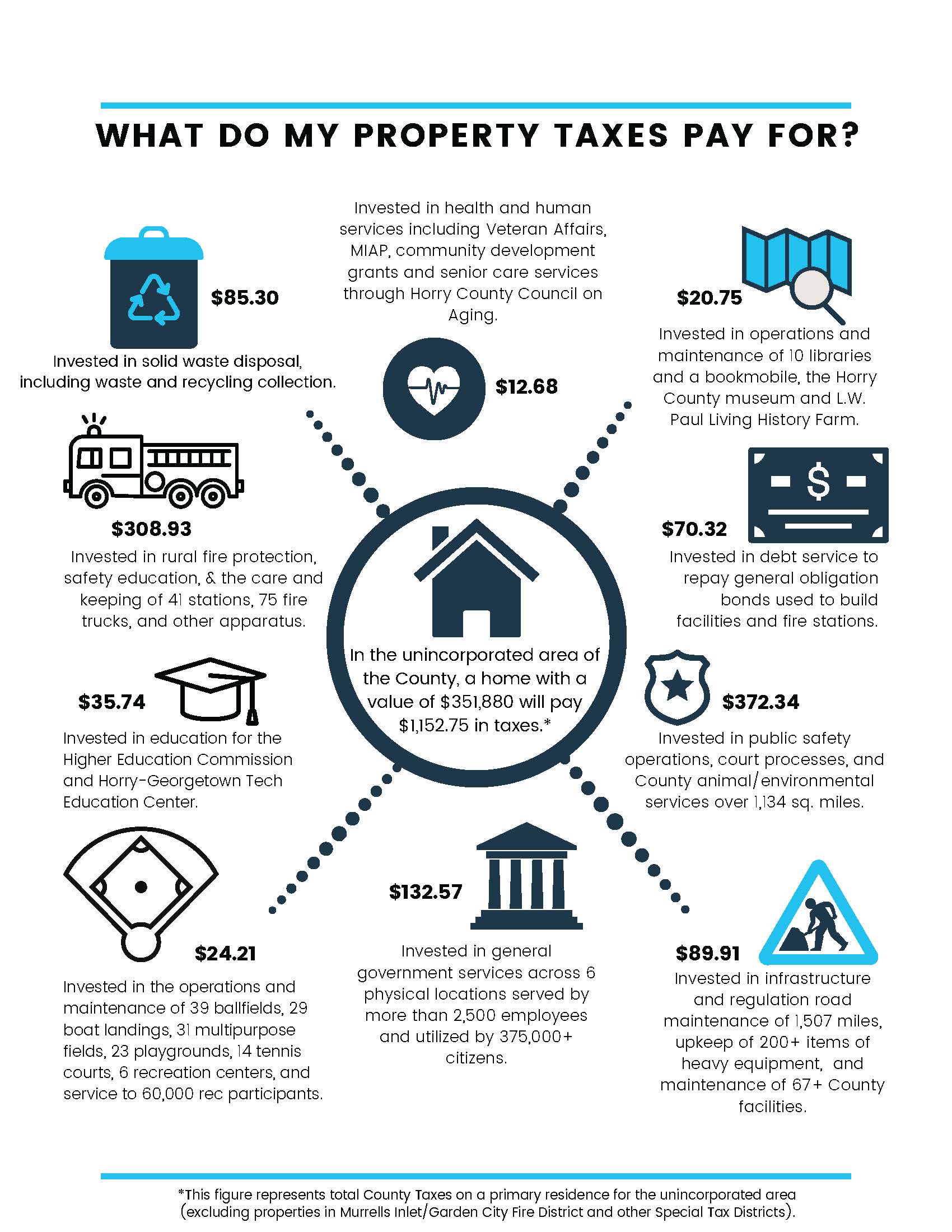

For example, the annual taxes paid to the County on a single-family home located in an unincorporated area of Horry County is invested in public safety, infrastructure, general government services, higher education, solid waste disposal, and County amenities like libraries and recreational offerings. Tax payments also contribute to debt service and health & human services (like Veteran Affairs, community development grants, and senior care services).

The photo attached is an example breakdown of a home in the unincorporated area of the County. This breakdown does not include special tax districts, taxes imposed by municipalities (if the home is located within city/town limits), or the Horry County Schools taxes.