New Property Tax Estimator Tool Available

Horry County has launched a new Tax Estimator to help property owners estimate what their real property tax bill may look like this fall.

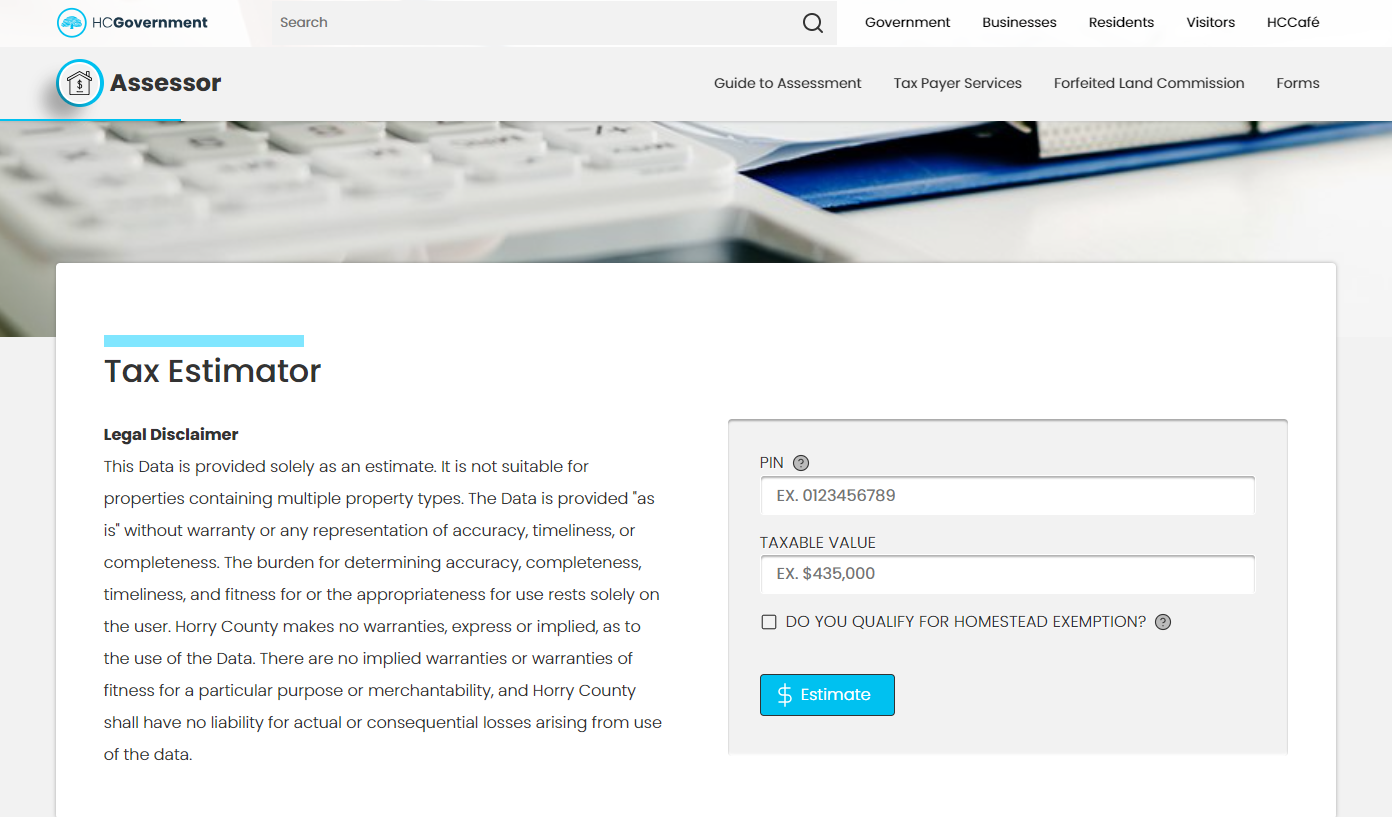

The tax estimator can be found here: https://www.horrycountysc.gov/departments/assessor/tax-estimator/

It’s important to note that this is just an estimate of what the tax bill for the property would look like this year. The data is provided “as-is”. A full legal disclaimer can be found alongside the estimator tool.

The property’s PIN number and taxable value are needed to use the tool. That information can be found on the Land Records webpage for the property and the assessment notices property owners may have received over the summer.

The tool will show the estimate for the property’s tax bill at the 4% ‘legal residence’ rate and the 6% ‘non-legal residence or commercial’ rate. The estimator will include the municipality millage for properties where appropriate.

The video here includes a step-by-step description of how to use the tax estimator.

For more information about this year’s reassessment, please see the attachment below.